- The Profit Pilot

- Posts

- Navigating the Numbers that Actually Matter

Navigating the Numbers that Actually Matter

The 3 Cash Flow Metrics Growth-Minded CEOs Should Know Cold

Hi there,

Let’s be honest — growing a business is hard. Especially when your financial dashboard is cluttered with metrics that don’t move the needle.

This week, we’re cutting through the noise and spotlighting 3 cash flow metrics that every serious business owner should be tracking consistently. These aren’t vanity metrics — they directly impact how well you can scale, invest, and sleep at night.

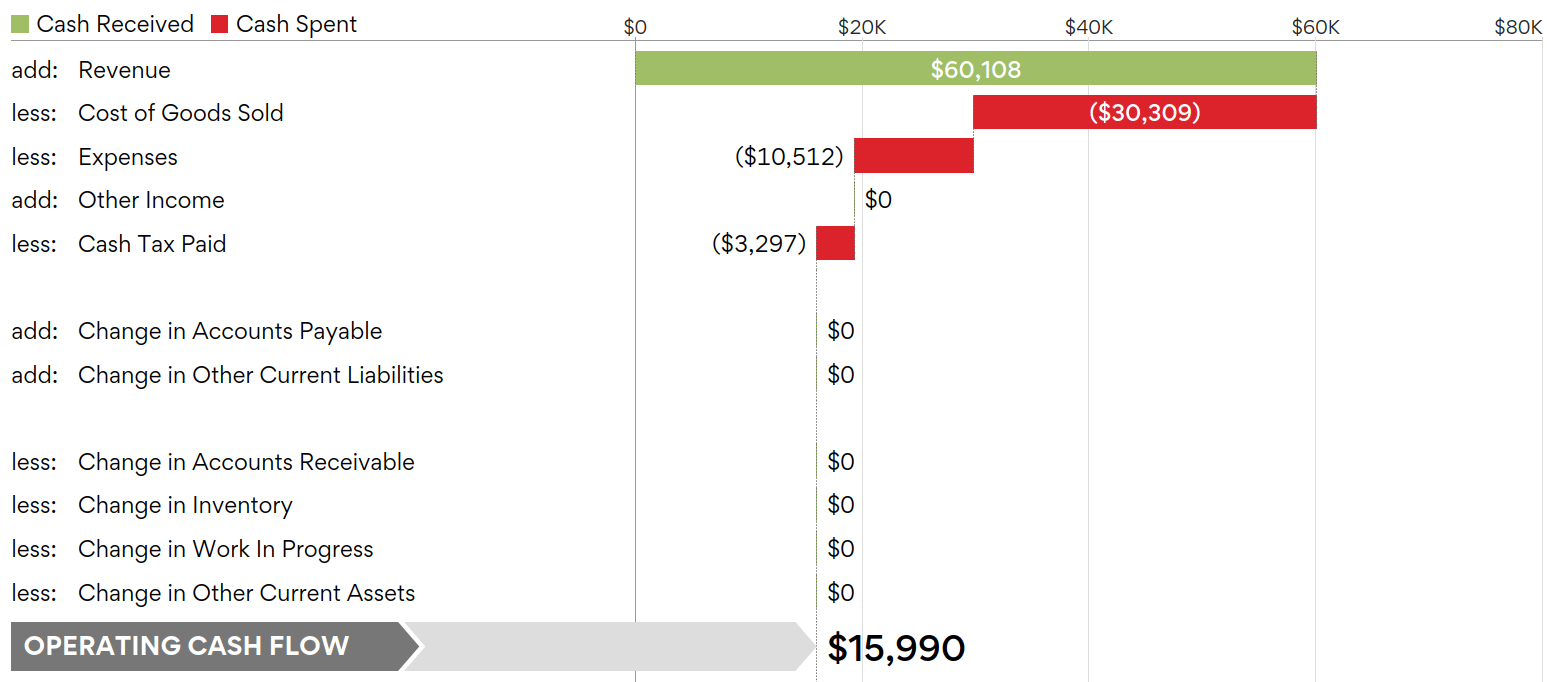

🔹 1. Operating Cash Flow (OCF)

What it tells you:

How much cash your business is generating from its core operations — no fluff, no financing, no one-time windfalls. Just pure business activity.

Why it matters:

Positive OCF means your business can sustain itself. Negative OCF? You may be funding your growth with debt or eating into reserves.

✅ Quick Tip: If your profits look great but OCF is always low, it’s time to dig into your receivables and payables.

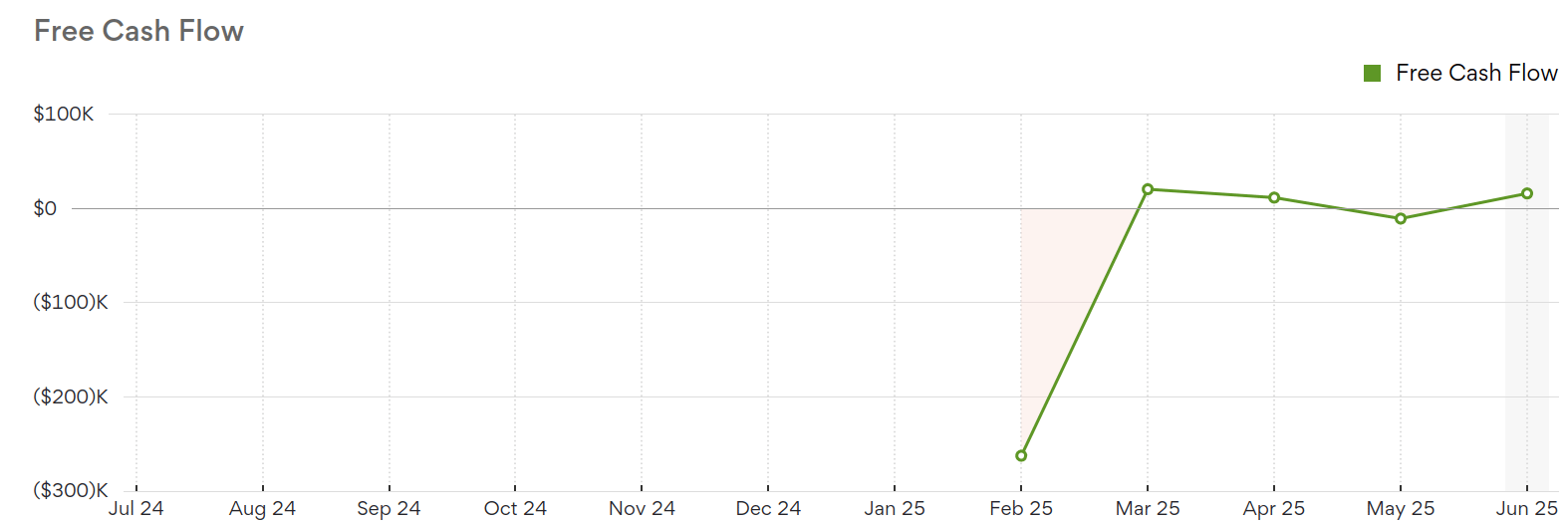

🔹 2. Free Cash Flow (FCF)

What it tells you:

How much money you actually have left over after covering major expenses like payroll, software, contractors, and any capital investments.

Why it matters:

This is your growth fuel. It’s what you use to invest in new hires, equipment, marketing, or just building a rainy day fund.

✅ Quick Tip: Tracking FCF monthly can prevent you from outgrowing your own infrastructure too fast.

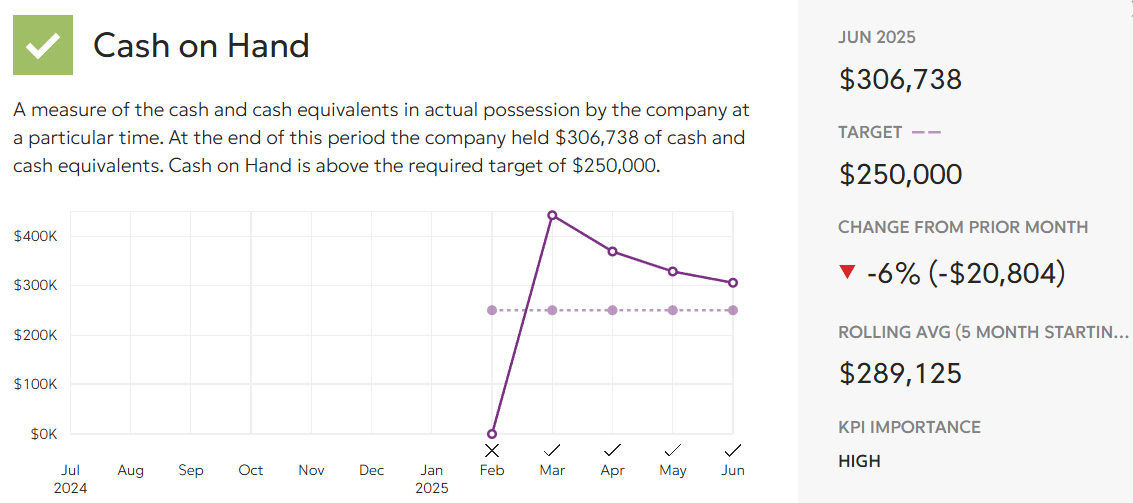

🔹 3. Cash on Hand / Cash Position

What it tells you:

Exactly how much accessible cash your business has right now. Think of it like your financial oxygen tank.

Why it matters:

You can’t run a business on promises. Cash on hand determines how long you can survive in a downturn, cover payroll, or grab a time-sensitive opportunity.

✅ Quick Tip: Aim to keep at least 2–3 months of operating expenses in reserves — it’s your business safety net.

Final Thought:

If you’re only looking at profit and loss, you’re only seeing part of the picture. True financial clarity comes from understanding how cash moves through your business.

Want help analyzing these numbers in your business? We do this every day for our clients.

Stay profitable,

Doyin Ogunbajo

The Profit Pilot

ASO Financial