- The Profit Pilot

- Posts

- Don’t Enter 2026 Blind — Your Year-End & Tax Planning Guide

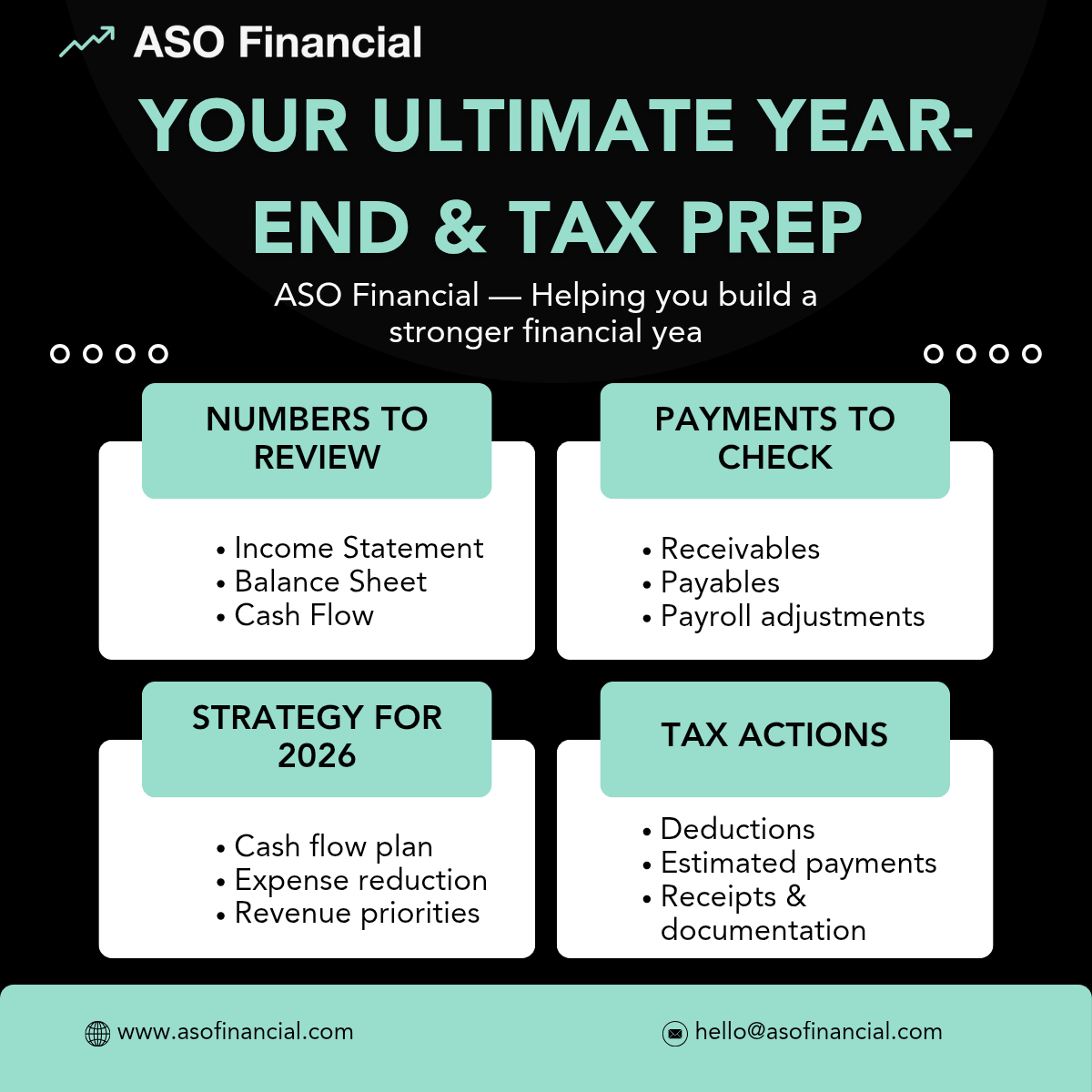

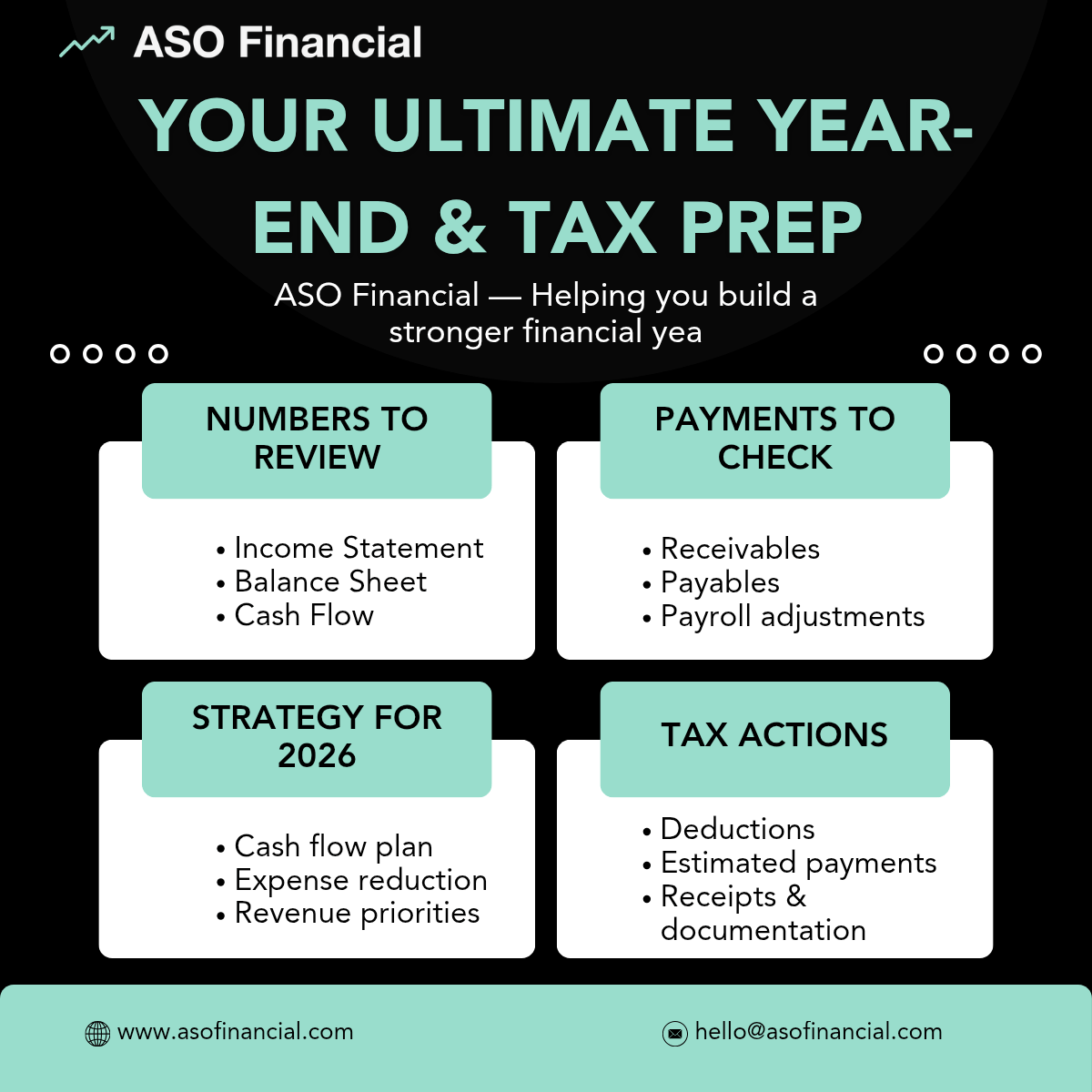

Don’t Enter 2026 Blind — Your Year-End & Tax Planning Guide

Year-End & Tax Planning Guide

Hi there,

As we wrap up the year, it’s the perfect time to prepare your business for tax season, clean up your books, and position yourself for a stress-free start to 2026.

Here are the top year-end and tax planning tasks every business should complete:

1. Review Your Financial Statements

Confirm that your income, expenses, and reconciliations are updated and accurate.

Clean books = smooth tax filing.

2. Track Outstanding Invoices & Bills

Collect what’s owed to you and settle aged bills.

This helps improve cash flow before year-end.

3. Check Payroll & Contractor Payments

Prepare W-2 and 1099 records early.

Avoid January rush and costly mistakes.

4. Maximize Tax Deductions

Expenses like software, equipment, and mileage can reduce your taxable income.

Don’t leave money on the table.

5. Review Quarterly Tax Payments

Check if you underpaid or overpaid.

Correcting this now prevents penalties later.

6. Plan for 2026 Cash Flow

Build your 13-week cash flow forecast and map out expected expenses, renewals, and payroll.

At ASO Financial, we help business owners wrap up the year confidently with:

Year-end bookkeeping cleanup

Tax-ready financial statements

Payroll & contractor compliance

Cash flow forecasting

Strategic tax planning

Need help closing your books or preparing for tax season? contact us today. [email protected]

Let’s make 2026 your most financially organized year yet.

Warm regards,

ASO Financial Team